☒ | No fee required. | ||||

☐ | Fee paid previously with preliminary materials. | ||||

☐ | Fee computed on table | ||||

March 23, 2018

Dear Fellow Shareholder:

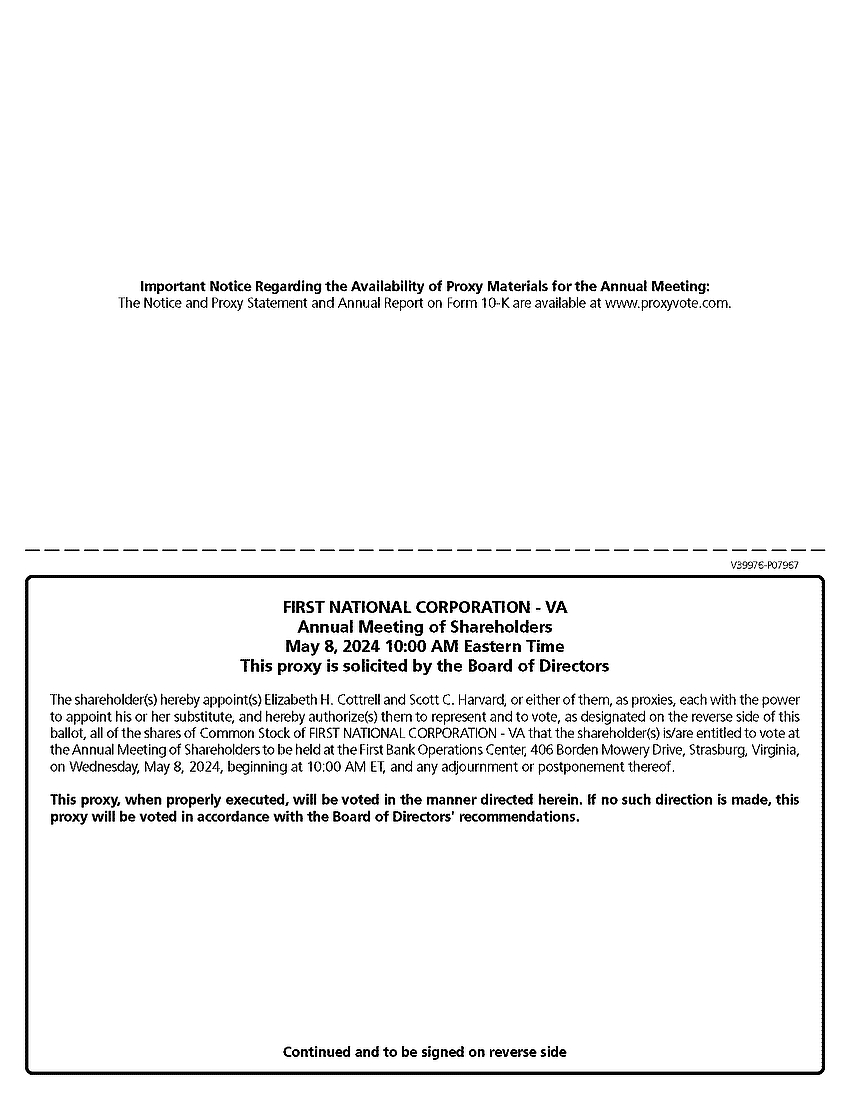

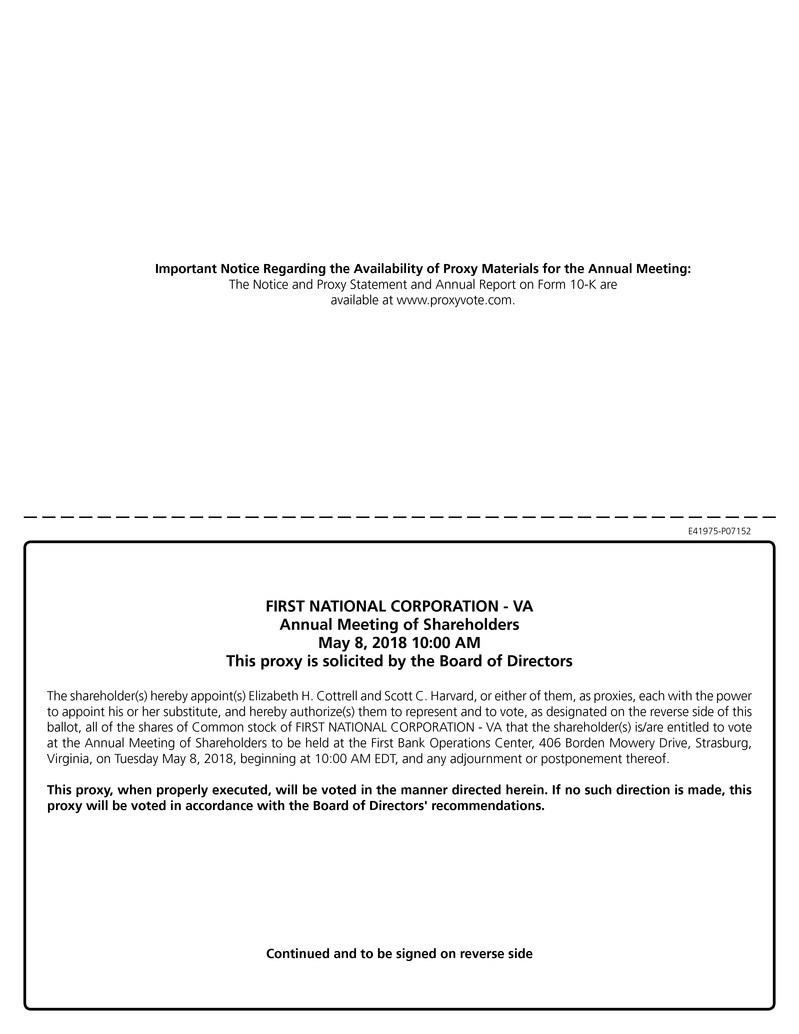

You are cordially invited to attend The First National Corporation’s 2018Corporation 2024 Annual Meeting of Shareholders. The meeting will be held on Tuesday,Wednesday, May 8, 20182024, at 10:00 a.m., Eastern Time, at the First Bank Operations Center, 406 Borden Mowery Drive, Strasburg, Virginia. The accompanying proxy statement describes the matters to be presented at the meeting.

We are furnishing proxy materials to our shareholders primarily over the Internet. You may read, print and download the 20172023 Annual Report on Form 10-K and the proxy statement at

Whether or not you plan to attend in person, it is important that your shares be represented, and your vote recorded. You may vote your shares by Internet, by telephone, by regular mail (if you request a paper copy), or in person at the Annual Meeting. Instructions regarding the various methods of voting are contained on the notice separately mailed to you or on the proxy card, as applicable. If you later decide to attend the meeting and vote in person, or if you wish to revoke your proxy for any reason prior to the vote at the meeting, you may do so, and your proxy will have no further effect.

The Board of Directors and management of the Company appreciate your continued support and we look forward to seeing you at the meeting.

Sincerely,

Scott C. Harvard

President and Chief Executive Officer

FIRST NATIONAL CORPORATION

112 West King Street

Strasburg, Virginia 22657

March 23, 2018

NOTICE OF 20182024 ANNUAL MEETING AND PROXY STATEMENT

The 20182024 Annual Meeting of Shareholders of First National Corporation will be held at the First Bank Operations Center, 406 Borden Mowery Drive, Strasburg, Virginia, on Tuesday,Wednesday, May 8, 2018,2024, beginning at 10:00 a.m., Eastern Time.

Whether or not you plan to attend the Annual Meeting, we urge you to vote and submit your proxy in advance of the meeting by one of the methods described in the proxy materials for the Annual Meeting.

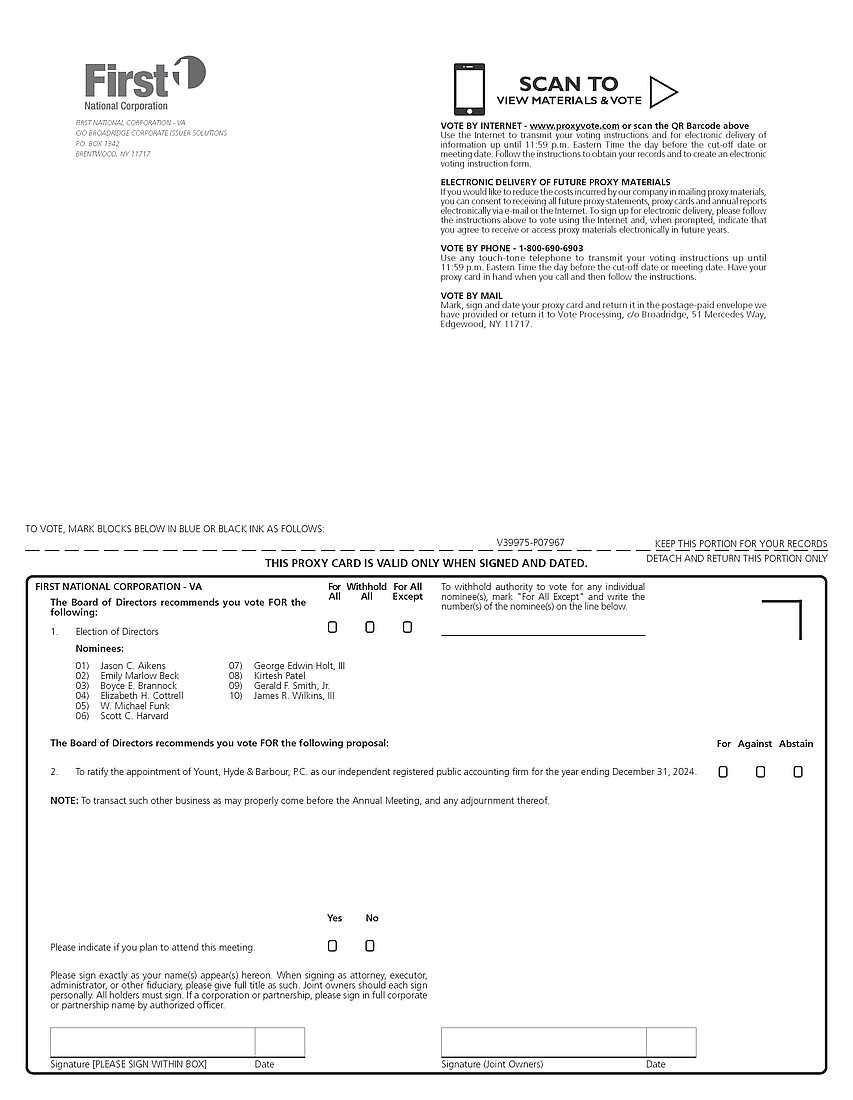

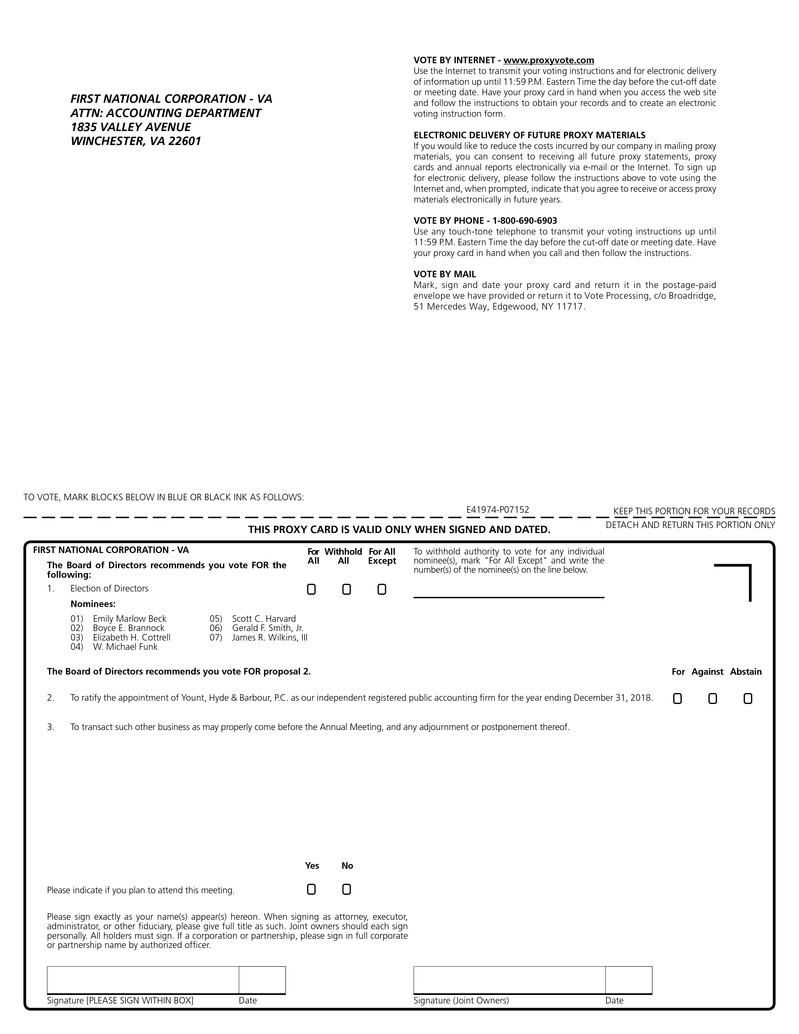

The items of business are:

1. | To elect |

2. | To ratify the appointment of Yount, Hyde & Barbour, P.C. as our independent registered public accounting firm for the year ending December 31, |

3. | To transact such other business as may properly come before the Annual Meeting. Management is not aware of any other business, other than procedural matters incident to the conduct of the Annual Meeting. |

Shareholders of record of First National Corporation common stock (FXNC) at the close of business on March 16, 2018,19, 2024, are entitled to notice of and to vote at the meetingAnnual Meeting and any postponements or adjournments of the meeting.

Gerald F. Smith, Jr.

Vice Chairman and Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 8, 2018:

GENERAL INFORMATION

This Proxy Statementproxy statement is furnished to holders of common stock, $1.25 par value per share (“Common(the “Common Stock”), of First National Corporation (the “Company”) in connection with the solicitation of proxies on behalf of the Company by the Board of Directors (the “Board”) of the Company to be used at the Annual Meeting of Shareholders to be held on May 8, 20182024 at 10:00 a.m. at the First Bank Operations Center, 406 Borden Mowery Drive, Strasburg, Virginia, and any adjournment thereof (the “Annual Meeting”).

We are furnishing our proxy materials primarily over the Internet rather than mailing paper copies of those materials to each shareholder. On or about March 23, 2018,29, 2024, we first mailed an Important Notice Regarding the Availability of Proxy Materials on the Internet (the “Notice”) to shareholders and posted our proxy materials on the Internet site referenced therein. These proxy materials include the accompanying notice of annual meeting,Annual Meeting, this proxy statement, the proxy card, and our Annual Report on Form 10-K for the year ended December 31, 2017.2023. The Notice provides information regarding how to access these proxy materials on the Internet, vote your shares or request a paper copy of these materials.

Only shareholders of record at the close of business on March 16, 201819, 2024 (the “Record Date”) will be entitled to vote at the Annual Meeting. On the Record Date, there were 4,952,5756,277,373 shares of Common Stock issued and outstanding and 565held by 802 shareholders of record and approximately 6061,143 additional beneficial owners of shares of Common Stock.

The principal executive offices of the Company are located at 112 West King Street, Strasburg, Virginia 22657.

Voting

Each share of Common Stock is entitled to one vote at the Annual Meeting. A majority of the shares of Common Stock entitled to vote, represented at the Annual Meeting in person or by proxy, constitutes a quorum for the transaction of business at the Annual Meeting.

Shareholders are encouraged to vote using any of the methods available to our shareholders. If you are a registered shareholder and attend the meeting, you may deliver your completed proxy card in person. “Street name” shareholders who wish to attend and vote atduring the meeting will need to contact your broker or agent to obtain a legal proxy form from the institution that holds their shares. The Company also is pleased to offer its shareholders the convenience of voting by phone and online via the Internet. Please review the Notice separately mailed to you or the proxy card, as applicable, for instructions. Please be aware that if you vote your shares by phone or over the Internet, you may incur costs or charges from your phone service or Internet access provider for which you are responsible.

If you execute a proxy by completing and returning a proxy card or voting by phone or online in time to be voted at the Annual Meeting, the shares represented by it will be voted in accordance with your instructions. Any shareholder giving a proxy has the power to revoke it at any time before it is exercised by (i) filing written notice thereof with the Secretary of the Company (Secretary, First National Corporation, c/o Broadridge Corporate Issuer Solutions, Inc., P.O. Box 1342, Brentwood, NYNew York 11717); (ii) submitting a subsequent vote using any of the methods described above; or (iii) appearing atattending the Annual Meeting or at any adjournment thereof and giving the Secretary notice of your intention to vote in person. If your shares are held in “street name,” and you want to change or revoke voting instructions you have given to the record holder of your shares, please follow the

A shareholder may abstain or (only with respect to the election of directors) withhold his or her vote (collectively, “Abstentions”) with respect to each item submitted for shareholder approval. Abstentions will be counted for purposes of determining the existence of a quorum. Abstentions will not be counted as voting in favor of or against the relevant item.

A broker who holds shares in “street name” has the authority to vote on certain items when it has not received instructions from the beneficial owner. Except for certain items for which brokers are prohibited from exercising their discretion, a broker is entitled to vote on matters presented to shareholders without instructions from the beneficial owner. “Broker shares” that are voted on at least one matter will be counted for purposes of determining the existence of a quorum for the transaction of business at the Annual Meeting. Where brokers do not have or do not exercise such discretion, the inability or failure to vote is referred to as a “broker nonvote.” Under the circumstances where the broker is not permitted to, or does not, exercise its discretion, assuming proper disclosure to the Company of such inability to vote, broker nonvotes will not be counted as voting in favor of or against the particular matter. A broker is prohibited from voting on the election of directors without instructions from the beneficial owner; therefore, there may be broker nonvotes on Proposal One. We expect that brokers will be allowed to exercise discretionary authority for beneficial owners who have not provided voting instructions with respect to Proposal Two; therefore, no broker nonvotes are expected to exist in connection with this proposal.

If no contrary instructions are given, each proxy executed and returned by a record shareholder will be voted for the election of the nominees described in this Proxy Statementproxy statement and for Proposal Two. The proxy also confers discretionary authority upon the persons named therein, or their substitutes, with respect to any other matter that may properly come before the Annual Meeting.

Solicitation of Proxies

Solicitation is being made by the Board of Directors by mail and electronic notice and access to the Internet. If sufficient proxies are not returned in response to this solicitation, supplementary solicitations may also be made by mail, telephone, electronic communication or in person by directors, officers and employees of the Company, its subsidiaries, or affiliates, none of whom will receive additional compensation for these services. The Company may retain an outside proxy solicitation firm to assist in the solicitation of proxies, but at this time does not have plans to do so. Costs of solicitation of proxies will be borne by the Company.

Executive Officers Who Are Not Directors

Executive Officer | Age | Position |

M. Shane Bell | 51 | Mr. Bell has served as Executive Vice President and Chief Financial Officer of the Company and First Bank (the “Bank”), its |

Dennis A. Dysart | 52 | Mr. Dysart has served as Senior Executive Vice President and Chief Operating Officer of the Company since August 2014 and has served as President and Chief Operating Officer of the Bank since June 2015. He |

PROPOSAL ONE:

ELECTION OF DIRECTORS

There are currently nineten directors serving on the Board, sevenall of whom are standing for reelectionre-election at the Annual Meeting to serve for a one-year term and until the election and qualification of their respective successors. Mr. Christopher E. French and Dr. Miles K. Davis have announced their intent to not stand for re-election at the Annual Meeting. The Company has amended its bylaws to provide that, as of the date of the 2018 Annual Meeting, the Board will consist of seven directors.

Unless authority is withheld in the proxy, each proxy executed and returned by a record shareholder will be voted for the election of the nominees listed below.

Proxies distributed in conjunction herewith may not be voted for persons other than the nominees named thereon. If any person named as nominee should be unable or unwilling to stand for election at the time of the Annual Meeting, the proxy holders will nominate and vote for a replacement nominee or nominees recommended by the Board. At this time, the Board knows no reason why any of the nominees listed below may not be able to serve as a director if elected. In the election of directors, those receiving the greatest number of votes will be elected even if they do not receive a majority.

Set forth below is the name of each nominee and, as to each of the nominees, certain information including age and the year in which the director was first elected to the Board. Additional information regarding the specific experience and skills of each nominee that led to the conclusion that the person should serve as director of the Company is also provided below. Unless otherwise indicated, the business experience and principal occupations shown for each nominee has extended five or more years.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS ATHAT YOU VOTE “FOR”“FOR” EACH OF THE FOLLOWING PERSONS NOMINATED BY THE BOARD.

Nominees

Nominee | Age | Director Since |

Emily Marlow Beck | 40 | 2014 |

| Boyce E. Brannock | 57 | 2017 |

| Elizabeth H. Cottrell | 67 | 1992 |

| W. Michael Funk | 65 | 2014 |

| Scott C. Harvard | 63 | 2011 |

| Gerald F. Smith, Jr. | 56 | 2007 |

| James R. Wilkins, III | 49 | 2001 |

Nominee | Age |

Director Since |

Jason C. Aikens | 43 | 2018 |

Emily Marlow Beck | 46 | 2014 |

Boyce Brannock | 63 | 2017 |

Elizabeth H. Cottrell | 73 | 1992 |

W. Michael Funk | 71 | 2014 |

Scott C. Harvard | 69 | 2011 |

George Edwin Holt, III | 71 | 2021 |

Kirtesh Patel | 50 | 2021 |

Gerald F. Smith, Jr. | 62 | 2007 |

James R. Wilkins, III | 55 | 2001 |

Jason C. Aikens is Vice President and Partner of Aikens Group, a real estate firm headquartered in Winchester, Virginia. With over twenty years of experience in the hospitality and real estate industry, Mr. Aikens and his team own and manage a diverse real estate portfolio consisting of hotels, multifamily units, and commercial real estate properties. Mr. Aikens has also served as a director of local non-profit organizations. His business experience and leadership roles in the community qualify him for service on the Board.

Emily Marlow Beck

is President of Marlow Motor Co., Inc. in Front Royal, Tri-State Nissan in Winchester, and Marlow Ford in Luray, Virginia, all of which are automotive sales and service firms. Prior to joining Marlow Motor Co. in 2010, she wasBoyce E. Brannock

Elizabeth H. Cottrell serves as ChairmanChair of the Board of the Company and the Bank. Mrs. Cottrell owns RiverwoodWriter, LLC, a writing/writing, editing and desktop publishing business in Maurertown, Virginia.Virginia, and is a published author. She brings experience in networking, marketing, and social media, and online marketing combined with her knowledge and connections gained as a previous member of the Shenandoah Memorial Hospital Foundation Board and the Shenandoah County School Board. Mrs. Cottrell currently serves onpreviously served as founding board member and Treasurer of the advisory councilMoore Educational Trust. She also served as a board member and chair of the Shenandoah Community Foundation. The insight Mrs. Cottrell provides from her 40 years of institutional knowledge, her experience as a business owner, and her leadership roles in the community qualify her for service on the Board.

W. Michael Funk

served as President,Scott C. Harvard

has served as President and Chief Executive Officer of the Company since May 2011 and has served as Chief Executive Officer of the Bank since June 2015. He had previously served as President and Chief Executive Officer of the Bank from May 2011 through May 2015. Prior to joining the Company, Mr. Harvard owned and operated Harvard Resources from 2009 to 2011, held the position of Executive Vice President of Hampton Roads Bankshares from 2008 to 2009 and held the position of President and Chief Executive Officer of Shore Financial Corporation, and itsGeorge Edwin Holt, III is the owner and served as president of RailCar Interchange, Inc., a freight car leasing company, which he founded in 2004 until his retirement in 2021. Mr. Holt had previously served The Bank of Fincastle as Chairman of the Board and was a member of the board directors since 2016. Currently, he serves on the board of directors of the Botetourt County Historical Society as President, Godwin Cemetery, and the Botetourt Preservation Partnership. Mr. Holt’s knowledge of markets, banking, and extensive experience in successful businesses qualify him for service on the Board.

Kirtesh Patel is President and Chief Executive Officer of OMMA Management, LLC in Salem, Virginia, a management company specializing in property, vendor, contract, operations, inventory, franchise, healthcare, long-term care nursing home and pharmacy management, consultation, and support. Mr. Patel had previously served on the board of The Bank of Fincastle since 2019. He was previously Chief Executive Officer of ApexCare Pharmacy Solutions, and Director of Operations for OmiCare, Roanoke, a publicly traded long-term care pharmacy company acquired by CVS Pharmacy. Mr. Patel also serves as Chairman of the Board of Directors of Richfield Recovery and serves as a member of the board of directors of Virginia Blue Ridge and Roanoke County Economic Development, and the United Way of Roanoke Valley. He is a graduate of Northeastern University in Boston and received a master’s in business administration degree from Averett University. Mr. Patel brings a wealth of knowledge in business management and strategic planning for businesses, which qualifies him for service on the Board.

Gerald F. Smith, Jr. is the served as Chairman, Chief Executive Officer, and President of Valley Proteins, Inc., a rendering business headquartered in Winchester, Virginia. He has been President since 1992 and Chairman and CEO since 2003.Virginia until his retirement following the sale of his business. Mr. Smith recently served as Chairman of the NationalNorth American Renderers Association and has served as a director of other associations in his industry. He is a Certified Public Accountant and has been licensed since 1986. The Board has designated him as the Company’s audit committee financial expert. Mr. Smith’sSmith also serves on the board of trustees of Shenandoah University. His leadership role in his business, industry, and in his industry,community, along with his finance and accounting knowledge, qualify him for service on the Board.

James R. Wilkins, III

is President of Silver Lake Properties, Inc. and General Partner of Wilkins Investments, L.P. and Wilkins Enterprises, L.P., all of which are real estate investment, development or management companies in Winchester, Virginia. Mr. Wilkins also serves on the board of trustees of Shenandoah University and the board of directors of Winchester Equipment Company. Mr. Wilkins previously served on the Board of Trustees of the Winchester Medical CenterSTOCK OWNERSHIP

Stock Ownership of Directors and Executive Officers

The following table sets forth information as of March 16, 2018,19, 2024, regarding the number of shares of Common Stock beneficially owned by all directors, by the executive officers named in the Summary Compensation Table and by all directors and executive officers as a group. Beneficial ownership includes shares, if any, held in the name of the spouse, minor children or other relatives of the director or executive officer living in such person’s home, as well as shares, if any, held in the name of another person under an arrangement whereby the director or executive officer can vest title in himself at once or at some future time, plus shares held in certain trust relationships that may be deemed to be beneficially owned by the nominees under the rules and regulations of the SEC;Securities Exchange Commission (“SEC”); however, the inclusion of such shares does not constitute an admission of beneficial ownership.

The address for each of the following individuals is First National Corporation, 112 West King Street, Strasburg, Virginia 22657.

Stock Ownership Table

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership (1) | Percent of Class (%) | ||||

| Emily Marlow Beck | 1,580 | * | ||||

| M. Shane Bell | 11,817 | * | ||||

| Boyce E. Brannock | 953 | (2) | * | |||

| Elizabeth H. Cottrell | 11,642 | * | ||||

| Miles K. Davis | 1,741 | * | ||||

| Dennis A. Dysart | 248,177 | (3) | 5.01 | % | ||

| Christopher E. French | 60,401 | (2)(4) | 1.22 | % | ||

| W. Michael Funk | 8,010 | * | ||||

| Scott C. Harvard | 35,353 | * | ||||

| Gerald F. Smith, Jr. | 68,755 | (2)(4) | 1.39 | % | ||

| James R. Wilkins, III | 389,784 | (2) | 7.87 | % | ||

All executive officers and directors as a group (11 persons) | 838,213 | (2)(3) | 16.92 | % | ||

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership (1) | Percent of Class (%) | |||||||

Jason C. Aikens | 21,088 | (2) | * | ||||||

Emily Marlow Beck | 27,031 | (2) | * | ||||||

M. Shane Bell | 28,826 | * | |||||||

Boyce Brannock | 5,541 | (2) | * | ||||||

Elizabeth H. Cottrell | 15,742 | * | |||||||

Dennis A. Dysart | 37,024 | * | |||||||

W. Michael Funk | 15,670 | * | |||||||

Scott C. Harvard | 68,952 | 1.10 | % | ||||||

George Edwin Holt, III | 44,664 | (2) | * | ||||||

Kirtesh Patel | 22,111 | * | |||||||

Gerald F. Smith, Jr. | 413,377 | (2) | (3) | 6.59 | % | ||||

James R. Wilkins, III | 417,012 | (2) | 6.64 | % | |||||

All executive officers and group (12 persons) | 1,117,038 | (2) | 17.80 | % | |||||

* Indicates that holdings amount to less than 1% of the issued and outstanding Common Stock.

(1) | |

For purposes of this table, beneficial ownership has been determined in accordance with the provisions of Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), under which, in general, a person is deemed to be the beneficial owner of a security if he has or shares the power to vote or direct the voting of the security or the power to dispose of or direct the disposition of the security, or if he has the right to acquire beneficial ownership of the security within 60 days. There were no shares for which any executive officer or director had the right to acquire beneficial ownership within 60 days. |

(2) | |

Amounts presented include shares of Common Stock that the individuals beneficially own indirectly through family members and affiliated companies and other entities, as follows: Mr. Aikens 15,190; Ms. Beck 20,870; Mr. Brannock, 110; Mr. |

(3) | |

Mr. Smith has disclaimed Beneficial Ownership of |

Stock Ownership of Certain Beneficial Owners

The following table sets forth, as of March 16, 2018,19, 2024, unless otherwise noted, certain information with respect to the beneficial ownership of shares of Common Stock by each person who owns, to the Company’s knowledge, more than 5% of the outstanding shares of Common Stock.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class (%) | ||

James R. Wilkins, III 1016 Lake St. Clair Drive Winchester, Virginia 22603 | 389,784 | (1) | 7.87% | |

Siena Capital Partners GP, LLC 100 N. Riverside Plaza, Suite 1630 Chicago, Illinois 60606 | 253,435 | (2) | 5.12% | |

Dennis A. Dysart 112 West King Street Strasburg, Virginia 22657 | 248,177 | (3) | 5.01% | |

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class (%) | ||||||

Fourthstone LLC 575 Maryville Center Drive, Suite 110 St. Louis, Missouri 63141 | 531,935 | (1) | 8.47 | % | ||||

James R. Wilkins, III 1016 Lake St. Clair Drive Winchester, Virginia 22603 | 417,012 | (2) | 6.64 | % | ||||

Gerald F. Smith, Jr. 549 Merrimans Lane Winchester, Virginia 22601 | 413,377 | (3) | 6.59 | % | ||||

Siena Capital Partners I, L.P. 205 West Wacker Drive, Suite 1950B Chicago, Illinois 60606 | 316,343 | (4) | 5.04 | % | ||||

(1) | According to Schedule 13G/A filed with the SEC on February 14, 2024, Fourthstone LLC reported that, as of December 31, 2023, it had shared voting power and shared dispositive power over 531,935 shares. |

(2) | The amounts presented include |

(3) | The amounts presented include |

(4) | According to Schedule 13G/A filed with |

Delinquent Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers, and any persons who own more than 10% of the outstanding shares of Common Stock, to file with the SEC reports of ownership and changes in ownership of Common Stock. Officers and directors are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms that they file. Based solely on review of the copies of such reports furnished to the Company or written representation that no other reports were required, the Company believes that, during fiscal year 2017,2023, its officers and directors complied with all such reporting requirements.

CORPORATE GOVERNANCE AND OTHER MATTERS

General

The business and affairs of the Company are managed under the direction of the Board in accordance with the Virginia Stock Corporation Act and the Company’s Articles of Incorporation and Bylaws. Members of the Board are kept informed of the Company’s business through discussions with the ChairmanChair of the Board, the President and Chief Executive Officer, and other officers, by reviewing materials provided to them and by participating in meetings of the Board and its committees.

Code of Conduct and Ethics

The Audit Committee of the Board has approved a Code of Conduct and Ethics for the Company’s directors and employees, including the principal executive officer and principal financial and accounting officer. The Code addresses such topics as protection and proper use of the Company’s assets, compliance with applicable laws and regulations, accuracy and preservation of records, accounting and financial reporting, and conflicts of interest. It is available on the Company’s website at

www.fbvirginia.com under “Investor Relations/Corporate Governance/Documents.”Board and Committee Meeting Attendance

Meetings of the Board are regularly held, at least once per quarter, including an organizational meeting following the conclusion of each Annual Meeting of Shareholders. There were twelveeleven meetings of the Board in 2017.2023. Each incumbent director attended greater than 75% of the aggregate number of meetings of the Board and meetings of committees of which the director was a member in 2017.

Director Independence

The Board has determined that the following directors are independent as that term is defined in the listing standards of the Nasdaq Stock Market, Inc. (“NASDAQ”Nasdaq”):

Jason C. Aikens | Elizabeth H. Cottrell | Kirtesh Patel |

Emily Marlow Beck | W. Michael Funk | Gerald F. Smith, Jr. |

Boyce | George Edwin Holt, III | James R. Wilkins, III |

The Board considered all relationships that directors had with the Company in determining independence. Christopher E. French is Chairman of the Board of Directors and President and Chief Executive Officer of Shenandoah Telecommunications Company, a business for which the Company made payments for telecommunications services. Dr. Miles K. Davis is the Dean of the Harry F. Byrd, Jr. School of Business at Shenandoah University, a school for which the Company made payment to sponsor an event. Most directors of the Company are directors, or hold similar positions, at multiple nonprofit and charitable organizations for which the Company made payments to sponsor events or in the form of charitable contributions. The Board determined that these transactions did not impair the independence of any director under NASDAQNasdaq listing standards.

There are no other transactions, relationships, or arrangements between the Company and any of the other independent directors except as set forth in “Certain Relationships and Related Party Transactions” in the Executive Compensation section of this Proxy Statement.proxy statement.

Committees

The Company has two standing committees, the Audit Committee and the Compensation and Governance Committee. Information regarding these committees is provided below.

The members of the

Audit Committee are:Emily Marlow Beck

W. Michael Funk

George Edwin Holt, III

Gerald F. Smith, Jr.

The Audit Committee assists the Board in fulfilling the Board’s risk oversight responsibilities. These responsibilities include ensuring the integrity of the Company’s consolidated financial statements, the Company’s compliance with legal and regulatory requirements, the qualifications, independence, and performance of the Company’s independent registered public accounting firm, and the performance of the internal audit function. The Audit Committee is directly responsible for the appointment, compensation, retention, and oversight of the work of the independent registered public accounting firm engaged for the purpose of preparing and issuing an audit report or performing other audit, review, or attestation services for the Company. The Board has adopted a written charter for the Audit Committee. The Audit Committee Charter is available on the Company’s website at

www.fbvirginia.comunder “Investor Relations/Corporate Governance/Documents.”The Board has determined in its business judgment that all members of the Audit Committee satisfy the independence and financial literacy requirements for audit committee members under NASDAQNasdaq listing standards and applicable SEC regulations. In addition, the Board has determined that Mr. Gerald F. Smith, Jr. qualifies as an audit committee financial expert as defined by SEC regulations and has designated him as the Company’s audit committee financial expert.

The Audit Committee met four times during the year ended December 31, 2017.2023. For additional information regarding the Audit Committee, see “Audit Committee Report” in the Audit-Related Matters section of this Proxy Statement.

The members of the

Compensation and Governance Committee are:Gerald F. Smith, Jr. (Chair)

Jason C. Aikens

Emily Marlow Beck

W. Michael Funk

Kirtesh Patel

The Compensation and Governance Committee’s risk oversight duties include reviewing and recommending the levels and types of compensation of officers and employees, including salaries, equity awards, bonuses, and benefits to the Board. The Committee also reviews and recommends employment agreements for the Chief Executive Officer and other compensation related matters, including fees paid to directors of the Company. The Committee is responsible for assisting the Board in developing a compensation philosophy for attracting, motivating, and retaining high-quality executives that will advance the interests of shareholders and delivering total compensation that is commensurate with performance. The Compensation and Governance Committee assists the Board of Directors in fulfilling its fiduciary responsibilities as to their oversight of management compensation and the organizational structure of the Company.

Management provides compensation recommendations for the Committee’s consideration and administers the Company’s executive compensation programs. Direct responsibilities of management include, but are not limited to:

● | Providing an ongoing review of the effectiveness of the compensation programs, including competitiveness, and alignment with the Company’s objectives; |

● | Recommending changes, if necessary, to ensure achievement of all program objectives; and |

● | Recommending pay levels and bonus payouts for executive officers other than the Chief Executive Officer. |

The Compensation and Governance Committee is also responsible for identifying, evaluating, and recommending candidates and nominees for Board membership. As part of that responsibility, the Committee conducts skills assessments of the directors, evaluates the adequacy of the current Board membership, and recommends changes where warranted. The Committee assists the Board in fulfilling its fiduciary responsibilities as to their risk oversight of the Company, including overseeing a Board education plan, and corporate governance matters, such as the determination of Board and Committee independence.

The Board has adopted a written charter for the Compensation and Governance Committee. The Compensation and Governance Committee Charter is available on the Company’s website at

www.fbvirginia.comunder “Investor Relations/Corporate Governance/Documents.”The Board has determined in its business judgment that all members of the Compensation and Governance Committee are independent as that term is defined in the listing standards of the NASDAQ.Nasdaq. The Compensation and Governance Committee met four times during the year ended December 31, 2017.

Director Selection Process

The Company does not have a separate nominating committee. The Compensation and Governance Committee performs the functions of a nominating committee in considering and recommending director nominees to the full Board. The Committee has established procedures that provide guidance for evaluating the composition of the Board, current directors, and director nominees. Procedures include, but are not limited to the following processes and evaluation criteria:

The Process

● | Evaluating the strengths and weaknesses of the existing Board and the need for additional Board positions; |

● | Considering candidates for Board membership suggested by its members and other Board members, as well as management and shareholders; |

● | Consulting about potential candidates with the |

● | Evaluating the prospective nominee against the specific criteria established for the position, including, but not limited to the criteria below; |

● | Interviewing the nominee if the Committee decides to proceed with further consideration; |

● | Recommending an action to the Board that makes the final determination whether to nominate or appoint the new director after considering the Committee’s report; and |

● | Generally maintaining criteria for Board positions which are utilized to evaluate directors and director nominees. |

The Evaluation Criteria

● | The ability to represent the interests of the shareholders of the Company; |

● | Standards of integrity, commitment, and independence of thought and judgment; |

● | The ability to dedicate sufficient time, energy, and attention to the diligent performance of his or her duties, including the prospective nominee’s service on other public company boards; |

● | The extent to which the prospective nominee assists in achieving a mix of Board members that achieves the proper balance of skills, expertise, experience, independence, diversity of thought and perspective, and community representation; |

● | The extent of contribution to the range of talent, skill, and expertise appropriate for the Board; |

● | The willingness to meet at least the minimum equity interest holding required by law; and |

● | The willingness to serve on the Board for an appropriate period of time to develop comprehensive knowledge about the Company’s principal operations. |

In the consideration of director nominees, including any nominee that a shareholder may submit (as described below), the Board considers, at a minimum, the above evaluation criteria factors for new directors, or the continued service of existing directors.

Shareholders entitled to vote for the election of directors may submit candidates for formal consideration by the Compensation and Governance Committee in connection with an annual meetingAnnual Meeting if the Company receives timely written notice, in proper form, for each such recommended director nominee. If the notice is not timely and in proper form, the nominee will not be considered by the Company. To be timely for the 20192025 Annual Meeting, the notice must be received within the time frame set forth in “Shareholder Communications” in the Other Information section of this Proxy Statement.proxy statement. To be in proper form, the notice must include each nominee’s written consent to be named as a nominee and to serve, if elected, and information about the shareholder making the nomination and the person nominated for election. These requirements are more fully described in Article II, Section F, of the Company’s Bylaws, a copy of which will be provided, without charge, to any shareholder upon written request to the Secretary of First National Corporation, whose address is First National Corporation, 112 West King Street, Strasburg, Virginia 22657.

In addition to fulfilling the evaluation criteria, each director brings a strong and unique background and set of skills to the Board, providing the Board as a whole competence and experience in a wide variety of areas.

The diversity of the Board is evaluated on a continuing basis by assessing whether varying viewpoints are routinely presented, evaluating the individual performance and contributions of each director, and ensuring that varying perspectives are presented on key issues.

Board Diversity Matrix (As of March 29, 2024) | ||||

Total Number of Directors | 10 | |||

Female | Male | Non- Binary | Did Not Disclose | |

Part I: Gender Identity | ||||

Directors | 2 | 7 | - | 1 |

Part II: Demographic Background | ||||

African American or Black | - | - | - | - |

Alaskan Native or American Indian | - | - | - | - |

Asian | - | 1 | - | - |

Hispanic or Latinx | - | - | - | - |

Native Hawaiian or Pacific Islander | - | - | - | - |

White | 2 | 6 | - | - |

Two or More Races or Ethnicities | - | - | - | - |

LGBTQ+ | - | |||

Did Not Disclose Demographic Background | 1 | |||

Leadership Structure of the Board

The positions of ChairmanChair of the Board and President and Chief Executive Officer of the Company have traditionally been held by separate persons. The principal role of the President and Chief Executive Officer is to execute on Board developed strategies and to manage the business of the Company in a safe, sound, and profitable manner. The role of the Board is to provide independent oversight of the President and Chief Executive Officer, formulate strategy and policy, and to monitor and measure risks within the Company.

Board’s Role in Risk Oversight

The Board oversees the Company’s enterprise risk management program to be reasonably certain that the Company’s risk management systems, policies, procedures, and practices are consistent with corporate strategy and functioning appropriately.

The Board performs its risk oversight in several ways. The Board’s role in enterprise risk management includes determining the Company’s risk tolerances in key risk categories and monitoring the level of risk within each category on a regular basis. The Board establishes standards for risk management across the enterprise by approving policies that address and mitigate the Company’s most material risks.risks and are aligned with the Company’s risk tolerances. These include policies addressing credit risk, interest rate risk, capital risk, liquidity risk, operational risk, and liquidityregulatory risk. The Board also monitors, reviews, and reacts to risk through various reports presented by management, internal and external auditors, and regulatory examiners.

The Board conducts certain risk oversight activities through its committees with direct oversight over specific functional areas. The risk oversight activities of the Audit and Compensation and Governance Committees are described in the “Committees” and “Audit-Related Matters” sections of this proxy statement. These committees are all comprised exclusively of independent directors.

The Board is empowered to create additional standing and ad hoc committees to facilitate regular monitoring and deeper analysis of matters that may arise from time to time. The Board also meets regularly in executive session to discuss a variety of topics, including risk, without members of management present.

In the foregoing ways, the Board is able to monitor the Company’s risk profile and risk management activities on an ongoing basis.

Attendance at the Annual Meeting of Shareholders

The Company encourages members of the Board to attend the Annual Meeting of Shareholders. There was only one director not able to attendAll directors attended the 20172023 Annual Meeting.

Communications with Directors

Any director may be contacted by writing to him or her c/o First National Corporation, 112 West King Street, Strasburg, Virginia 22657. Communications to the non-management directors as a group may be sent to the same address, c/o the Secretary of First National Corporation. The Company promptly forwards, without screening, all such correspondence to the indicated directors.

Anti-Hedging Policy

The Company currently does not have any policies with respect to financial instruments or transactions in derivative securities or otherwise that hedge or offset any decrease in the market value of the Company’s common stock.

EXECUTIVE COMPENSATION

The Company strives to attract, motivate, and retain high-quality executives by providing total compensation that is performance-based and competitive with the various labor markets and industries in which the Company competes for talent. The Company provides incentives to advance the interests of shareholders and deliver levels of compensation that are commensurate with performance. Overall, compensation plans are designed to support the Company’s corporate business strategy and business plan. Expectations are clearly communicated to executives with respect to goals and results and by rewarding achievement. The Company focuses on retaining and recruiting talented executives that can create strong financial performance aligned with shareholders’ interest.interests. The Company attempts to achieve these objectives through three key compensation elements: base salary, performance-based cash compensation, and equity compensation, along with retirement and health benefits.

Summary Compensation Table

The following table provides information concerning total compensation earned or paid to the Chief Executive Officer and the two other most highly compensated executive officers of the Company who served in such capacities as of December 31, 20172023 for services rendered to the Company. These executive officers are referred to as the named executive officers in this proxy statement. The named executive officers received compensation from First Bank, a wholly-owned subsidiary of First National Corporation. The named executive officers did not receive any compensation from the Company. Employment agreements for named executive officers are described in more detail below under the headings “Employment Agreements” and “Potential Payments Upon Termination or Change of Control.” In 2017, awards were granted under the Executive Incentive Plan.

Summary Compensation Table

Name and Principal Position | Year | Salary ($) | Stock Awards ($)(1) | Non-Equity Incentive Plan Compensation ($)(2) | All Other Compensation ($)(3) | Total ($) | |||||

| Scott C. Harvard | 2017 | 314,090 | 50,525 | 126,030 | 13,425 | 504,070 | |||||

| President | 2016 | 309,565 | 41,774 | 128,119 | 24,433 | 503,891 | |||||

| Chief Executive | |||||||||||

| Officer | |||||||||||

| Dennis A. Dysart | 2017 | 213,677 | 10,245 | 64,533 | 12,203 | 300,658 | |||||

| Senior Executive Vice | 2016 | 209,093 | 10,094 | 64,373 | 12,917 | 296,477 | |||||

| President | |||||||||||

| Chief Operating Officer | |||||||||||

| M. Shane Bell | 2017 | 192,297 | 8,086 | 60,983 | 15,154 | 276,520 | |||||

| Executive Vice | 2016 | 188,171 | 7,973 | 59,437 | 15,317 | 270,898 | |||||

| President | |||||||||||

| Chief Financial Officer | |||||||||||

Name and Principal Position | Year | Salary | Stock Awards (1) | Non- Equity Incentive Plan Compensation (2) | All Other Compensation (3) | Total | |||||||||||||||

Scott C. Harvard | 2023 | $ | 435,865 | $ | 128,042 | $ | - | $ | 29,561 | $ | 593,468 | ||||||||||

President | 2022 | $ | 405,734 | $ | 124,397 | $ | 218,416 | $ | 25,370 | $ | 773,917 | ||||||||||

Chief Executive Officer | |||||||||||||||||||||

Dennis A. Dysart | 2023 | $ | 289,871 | $ | 64,407 | $ | - | $ | 38,255 | $ | 392,533 | ||||||||||

Sr. Executive Vice President | 2022 | $ | 266,014 | $ | 64,196 | $ | 100,196 | $ | 35,819 | $ | 466,225 | ||||||||||

Chief Operating Officer | |||||||||||||||||||||

M. Shane Bell | 2023 | $ | 262,698 | $ | 63,039 | $ | 37,769 | $ | 43,015 | $ | 406,521 | ||||||||||

Executive Vice President | 2022 | $ | 240,698 | $ | 62,909 | $ | 87,286 | $ | 38,111 | $ | 429,004 | ||||||||||

Chief Financial Officer | |||||||||||||||||||||

(1) | The amounts reported reflect the aggregate grant date fair value of the awards for the fiscal year ended December 31, |

(2) | This column includes payments earned during |

(3) | “All Other Compensation” represents matching contributions by the Company to the named executive officer’s account in the Company’s 401(k) plan, life insurance premiums, personal use of Company vehicles, and club dues paid on their behalf. |

Compensation Philosophy

In October 2016,September 2021, the Board of DirectorsCompensation and Governance Committee engaged Matthews, Young & Associates, Inc.,Pearl Meyer, a compensation consulting firm, to review the Bank’s executive compensation, identify strengths, weaknesses, and voids, and make directional recommendations based on the Bank’s philosophy and strategy. Their work included a review of both corporate strategy and compensation strategy and examiningexamined external competitiveness of compensation and internal equity among the executive team on all components of compensation. As a result of their evaluation, the Company retained its executive compensation program that serves to attract and retain the management talent needed to successfully lead the Company and increase shareholder value. It rewards executives for their knowledge and skill used in carrying outfulfilling their responsibilities and motivates their behavior by rewarding desired performance or theand meeting of established corporate objectives.

The Company’s executive compensation program primarily consists of base salaries, annual incentive bonuses, long-term incentives in the form of equity-based compensation, retirement compensation, and retirement compensation.

Base salary

represents the fixed component of the Company's executive compensation program and is designed to provide compensation to executives based upon their experience, duties, and scope of responsibilities.Annual incentive bonuses

may be provided through the Company’s Executive Incentive Plan andLong-term equity-based incentive compensation

may be provided through theRetirement compensation

is provided through supplemental executive retirement plans intended to provide additional incentives and supplemental retirement income and a 401(k) planThe Chief Executive Officer recommends the compensation of other named executive officers to the Compensation and Governance Committee, which may include base salary, performance goals for annual incentive plans, bonuses, and equity compensation. The Chief Executive Officer makes no recommendations concerning his own compensation and is not present when his compensation is being discussed or approved. The Compensation and Governance Committee reviews and recommends the compensation of the Chief Executive Officer to the Board of Directors, which also includes base salary, performance goals for annual incentive plans, bonuses, and equity compensation.

Shareholder Advisory Votes

At the Company’s 2022 Annual Meeting, approximately 98% of the shareholders who voted on the advisory vote on executive compensation approved the compensation paid to the Company’s named executive officers. The Compensation and Governance Committee believes this level of shareholder support provides an affirmation of the Company’s current compensation philosophy and pay practices. The Compensation and Governance Committee will continue to consider the outcome of the Company's shareholder advisory votes and other input from shareholders when making future compensation decisions for the named executive officers.

At the Company’s 2019 Annual Meeting, the shareholders voted on the frequency with which the advisory vote on executive compensation should be held in the future – every one, two or three years. Consistent with the shareholders’ selection, the Company will follow a three-year cycle, and shareholders will be asked to vote on it again in 2025.

Clawback Policy

During 2023, the Company adopted a clawback policy that requires mandatory reimbursement of excess incentive compensation from any current or former executive officer if the Company’s financial statements are restated due to material noncompliance with financial reporting requirements under the securities laws. The amount to be recovered will be the excess of incentive compensation paid to the executive based on the erroneous data over the incentive compensation that would have been paid to the executive had it been based on the restated results. Recoupment would cover any excess compensation received during the three completed fiscal years immediately preceding the date of which the Company is required to prepare the accounting restatement.

Executive Incentive Plan

In November 2012, the Board of Directors adopted a cash Executive Incentive Plan (the "EIP") to reward certain executive officers for achieving performance goals. A revised EIP was adopted by the Board in March 2013. The duration of the EIP is indefinite, and the EIP may be amended or terminated by the Board at any time. Participation is limited to those employees selected by the Chief Executive Officer and approved by the Compensation and Governance Committee of the Board each EIP year. Scott C. Harvard, Dennis A. Dysart, and M. Shane Bell were selected to participate in the EIP along with certain other employees, effective January 1, 2017.

Under the Plan,EIP, the Board is responsible for establishing and approving annual performance objectives for the Company and PlanEIP participants, based upon such criteria as may be recommended by the Chief Executive Officer (or, in the case of the Chief Executive Officer, by the Compensation Committee), and the award formula by which all incentive awards under the PlanEIP are calculated. Plan participantsParticipants are entitled to a cash distribution under this Plan if, upon the approval of the Board, the Plan award is earned as a result of the attainment of PlanEIP performance objectives, and the participant is employed on the payment date. Awards shall be paid on or after January 1 of the year following the performance period, and no later than March 15 of the year following the performance period.

In the event of a participant’s termination of employment for any reason, including due to death, permanent disability, or retirement, any unpaid awards (including any earned but unpaid awards) shall be forfeited by such participant. The Company has the right to recover compensation that the Company determines, in its sole discretion, was unjustly paid to an employee under the Plan.EIP. Under the EIP, the Board reserves the right to withhold or adjust individual awards. The Board has not exercised its discretion to withhold bonus payments in the past.

In February 2018,March 2024, the Company paid awards under the EIP to Scott C. Harvard, Dennis A. Dysart, and M. Shane Bell. The awards were based on achievement of the Company’s financial performance goals including loan growth, profitability ratios,that included the efficiency ratio and earnings.earnings for 2023. These amounts are disclosed as Non-Equity Incentive Plan Compensation for 20172023 in the Summary Compensation Table above.

2014 Stock Incentive Plan

The Company’s 2014 Stock Incentive Plan (the ��“2014 SIP”) was adopted by the Board of Directors on March 12, 2014, and approved at the Annual Meeting of Shareholders on May 13, 2014. The Plan makes available up to 240,000 shares of common stock for the granting of stock options, restricted stock awards, stock appreciation rights, and other stock-based awards. The Board believes the Plan will beis an important factor in attracting, retaining, and rewarding the high caliber individuals essential to the Company’s long-term success. The Board further believes that ownership of the Company’s common stock will stimulate the efforts of those individuals upon whose judgment, interest, and efforts the Company is and will be largely dependent for the successful conduct of its business and will further align the interests of those individuals with the interests of the Company’s shareholders.

On February 8, 2017,2023, the Company granted 1,324, 674, and 5324,795 restricted stock units (“RSUs”) under the 2014 SIP to Scott C. Harvard, 2,464 RSUs to Dennis A. Dysart, and 2,230 RSUs to M. Shane Bell, respectively.Bell. The grants represented long-term compensation and enhanced retention of the named executive officers. Each restricted stock unit represented a contingent right to receive one share of First National Corporation common stock.Common Stock. One-third of the RSUs granted vested immediately,on February 15, 2023, with the remainder vesting in two equal annual installments beginning February 15, 2024. Additionally, on February 15, 2023, the Company granted 5,701 shares of Common Stock under the 2014 SIP to Scott C. Harvard, 2,850 shares of Common Stock to Dennis A. Dysart, and 2,850 shares of Common Stock to M. Shane Bell.

The Company’s 2014 SIP was replaced by the 2023 Stock Incentive Plan on May 10, 2023, upon the approval of the 2023 Stock Incentive Plan by the Company’s shareholders.

2023 Stock Incentive Plan

The Company’s 2023 Stock Incentive Plan was adopted by the Board of Directors on February 8, 2018.

Employment Agreements

On May 20, 2014, the Company entered into an employment contractagreement with Scott C. Harvard. The term of the agreement began on May 20,22, 2014, and continued until May 21, 2016. On May 21, 2016,2015, the agreement was extended for one year and has automatically extendedextends for one year each May 21 thereafter, until Mr. Harvard or the Company provides notice to the other party prior to the end of the applicable term.

On June 1, 2007, the Company entered into amended and restated employment agreements with Dennis A. Dysart and M. Shane Bell, which agreements were amended December 1, 2008. The contractterm of each of these agreements is at all times two years, which means that at the end of every day, the term is extended for one day.

The employment agreements with each of Mr. Harvard, providesMr. Dysart and Mr. Bell provide for his service as President and Chief Executive Officercertain severance payments to the employee if the employee is terminated without “cause” or resigns for “good reason” or in the event of botha “change of control” (as those terms are defined in the Company andrespective employment agreement). These provisions are summarized below under the Bank at an initial base annual salaryheading “Potential Payments Upon Termination or Change of $300,000.

Each of these employment agreements also contains restrictive covenants relating to the protection of confidential information, non-disclosure, non-competition, and non-solicitation. The non-competition and non-solicitation covenants continue generally for a period of 12 months following the last day of his employment.

The employee will not be entitled to any termination compensation and benefits if he breaches any of the covenants in the agreement relating to the protection of confidential information, non-disclosure, non-competition, and non-solicitation. He will also not be entitled to any compensation or other benefits, other than payment for all time worked, if his employment is terminated for cause or if Mr. Harvard terminates his employment for other than good reason.

Retirement Benefits

The Company also maintains a 401(k) plan and an employee stock ownership plan (ESOP) for all eligible employees. Participating employees may elect to contribute up to the maximum percentage allowed by the Internal Revenue Service, as defined in the 401(k) plan. The Company makes matching contributions, on a dollar-for dollar basis, for the first one percent of an employee’s compensation contributed to the 401(k) plan and fifty cents for each dollar of the employee’s contribution between two percent and six percent. The Company also makes an additional contribution based on years of service to participants who have completed at least one thousand hours of service during the year and who are employed on the last day of the 401(k) plan year. All employees who are age nineteen or older are eligible for the 401(k) plan.

The Company did notBank also has entered into supplemental executive retirement plans (the “SERPs”) with each of Mr. Harvard, Mr. Dysart, and Mr. Bell. The SERP agreements provide nonqualified deferred compensation plans for employees during 2017.a normal retirement benefit (equal to $66,667 per year for Mr. Harvard, $70,103 per year for Mr. Dysart and $64,926 per year for Mr. Bell), payable in 180 monthly installments, beginning upon the officer’s separation from service at or after retirement age (68 for Mr. Harvard, and 65 for Mr. Dysart and Mr. Bell). In the event of an officer’s early retirement or voluntary or involuntary separation from service prior to normal retirement age, he will be entitled to receive the portion of such benefit that has been accrued at that time.

In addition, the SERP agreements provide that the officer will be entitled to the present value of his normal retirement benefit upon his separation from service within two years of a “Change in Control” (as defined in the SERP).

Holdings of Stock Awards

The following table contains information concerning unvested stock awards atas of December 31, 20172023 for each of the named executive officers.

Outstanding Equity Awards

Fiscal Year End 2017

| Stock Awards | |||

Grant Date | Number of Shares or Units of Stock That Have Not Vested (#)(1) | Market Value of Shares or Units of Stock That Have Not Vested ($)(2) | |

| Scott C. Harvard | 2/10/2016 | 1,582 | 28,476 |

| 2/8/2017 | 882 | 15,876 | |

| Dennis A. Dysart | 2/10/2016 | 382 | 6,876 |

| 2/8/2017 | 449 | 8,082 | |

| M. Shane Bell | 2/10/2016 | 302 | 5,436 |

| 2/8/2017 | 354 | 6,372 | |

Stock Awards

| |||||||||

Grant Date | Number of Shares or Units of Stock That Have Not Vested (#) (1) | Market Value of Shares or Units of Stock That Have Not Vested ($) (2) | |||||||

Scott C. Harvard | 2/9/2022 | 1,098 | 23,882 | ||||||

2/8/2023 | 3,196 | 69,513 | |||||||

Dennis A. Dysart | 2/9/2022 | 612 | 13,311 | ||||||

2/8/2023 | 1,642 | 35,713 | |||||||

M. Shane Bell | 2/9/2022 | 554 | 12,050 | ||||||

2/8/2023 | 1,486 | 32,321 | |||||||

(1) | Amounts are comprised of unvested restricted stock units |

(2) | Amounts represent the fair market value of the restricted stock |

Equity Compensation Plan

The following table sets forth the information atas of December 31, 2017,2023, with respect to compensation plans under which shares of Common Stock are authorized for issuance:

Number of Securities to Be Issued upon Exercise of Outstanding Options, Warrants and Rights (1) | Weighted Average Exercise Price of Outstanding Options, Warrants and Rights (1) |

Number of Securities Remaining Available for Future Issuance under Equity Compensation Plans | ||||||||||

Equity Compensation Plans Approved by Shareholders: | ||||||||||||

2014 Stock Incentive Plan | 40,551 | - | - | |||||||||

| 2023 Stock Incentive Plan | - | - | 313,300 | |||||||||

Equity Compensation Plans Not Approved by Shareholders (2) | - | - | - | |||||||||

Totals | 40,551 | - | 313,300 | |||||||||

(1) | Includes restricted stock units that are not included in the calculation of weighted average exercise price. | ||

(2) | |||

The Company does not have any equity compensation plans that have not been approved by shareholders. |

Potential Payments Upon Termination or Change of Control

Each employment contractagreement with Mr. Harvard, Mr. Dysart, and Mr. Bell provides that the officer’s employment may be terminated by the Company with or without cause. If he resigns for “good reason” or is terminated without “cause” (as those terms are defined in the respective employment agreement), however, he is entitled to his salary and benefits for the remainder of his contract. If his employment terminates for good reason or without cause within one year of a change in control of the Company, he will be entitled to severance payments approximately equal to 299% of his annual cash compensation for a period that precedes the change in control as determined under the Internal Revenue Code of 1986, as amended. The following table provides payments that could be due the named executive officers under different scenarios:

Potential Payments Under Employment Agreements Upon Termination or Change of Control

Name | Terminate Employment for Good Reason or Without Cause ($)(1) | Terminate Employment for Good Reason or Without Cause Within 12 months Post Change of Control ($)(2) |

| Scott C. Harvard | 391,127 | 1,209,021 |

| Dennis A. Dysart | 446,291 | 793,355 |

| M. Shane Bell | 402,335 | 708,674 |

Name | Terminate Employment for Good Reason or Without Cause (1) |

Terminate Employment for Good Reason or Without Cause Within 12 months Post Change of Control (2) | ||||||

Scott C. Harvard | $ | 612,827 | $ | 1,863,210 | ||||

Dennis A. Dysart | $ | 594,288 | $ | 1,140,977 | ||||

M. Shane Bell | $ | 545,903 | $ | 1,036,042 | ||||

(1) | Mr. Harvard, Mr. Dysart, and Mr. Bell would have received the payments from the Company shown in the above table for termination of employment as of |

(2) | Mr. Harvard, Mr. Dysart, and Mr. Bell would have received the payments from the Company shown above for termination of employment as of |

Each contract also contains a covenant not to compete that is in effect while the officer is an officer and employee of the Company and for a 12-month period after termination of his employment.

In addition, the SERP agreements with Mr. Harvard, Mr. Dysart and Mr. Bell provide that the officer will be entitled to the present value of his normal retirement benefit upon his separation from service within two years of a “Change in Control” (as defined in the SERP). The SERP agreements also contain restrictive covenants relating to non-competition and non-solicitation that continue generally for a period of 24 months following his separation from service.

The Company has granted 3,309, 1,320, and 1,200 RSUs under the 2014 SIP to Scott C. Harvard, Dennis A. Dysart, and M. Shane Bell respectively. The grants represented long-term compensation and enhanced retention of the named executive officers. Each restricted stock unit representedthat represent a contingent right to receive one share of First National Corporation common stock. One-thirdstock upon vesting. The Compensation Committee may provide for the acceleration of the RSUs granted vested immediately,vesting schedule relating to the exercise of these awards in the event of a change in control.

PAY VERSUS PERFORMANCE

The following table provides information on total compensation and compensation actually paid to our principal executive officer (“PEO”) and to our remaining named executive officers (“NEOs”) for the fiscal years ended December 31, 2023 and December 31, 2022, and the cumulative shareholder return on our common stock and our net income over the same time period.

Pay versus Performance Table

Year | Summary Compensation Table Total for PEO(1) | Compensation Actually Paid to PEO(1)(2) |

Average Summary Compensation Table Total for Non-PEO NEOs(3) | Average Compensation Actually Paid to Non-PEO NEOs(3)(4) | Value of Initial Fixed $100 Investment Based on Total Shareholder Return | Net Income (in thousands) | ||||||||||||||||||

| 2023 | $ | 593,468 | $ | 669,071 | $ | 399,527 | $ | 436,767 | $ | 131.26 | $ | 9,624 | ||||||||||||

2022 | $ | 773,917 | $ | 807,184 | $ | 447,615 | $ | 465,254 | $ | 107.54 | $ | 16,797 | ||||||||||||

2021 | $ | 600,568 | $ | 615,650 | $ | 378,011 | $ | 386,771 | $ | 139.89 | $ | 10,359 | ||||||||||||

(1) | During 2023, 2022 and 2021, Scott C. Harvard was our PEO. |

(2) | The following table sets forth the adjustments made to arrive at compensation “actually paid” to our PEO during 2023: |

Adjustments to determine compensation “actually paid” for PEO | 2023 | |||

Deduction for amounts reported under the “Stock Awards” column in the Summary Compensation Table | $ | (128,042 | ) | |

Increase for fair value of awards granted during year that remained unvested at year-end | 69,513 | |||

Increase for fair value of awards granted during year that vested during year | 128,042 | |||

Change in fair value from prior year-end to year-end of awards granted in a prior year that were outstanding and unvested at year-end | 5,073 | |||

Change in fair value from prior year-end to vesting date of awards granted in a prior year that vested during year | 1,017 | |||

Deduction for fair value of awards granted in a prior year that were forfeited during year | - | |||

Increase based upon incremental fair value of awards modified during year | - | |||

Increase based on dividends or other earnings paid during year prior to vesting | - | |||

Total Adjustments | $ | 75,603 | ||

(3) | During 2023, 2022, and 2021, our remaining NEOs consisted of Dennis A. Dysart and M. Shane Bell. |

(4) | The following table sets forth the adjustments made to arrive at average compensation “actually paid” to our remaining NEOs during 2023: |

Adjustments to determine compensation “actually paid” for non-PEO NEOs | 2023 | |||

Deduction for amounts reported under the “Stock Awards” column in the Summary Compensation Table | $ | (63,723 | ) | |

Increase for fair value of awards granted during year that remained unvested at year-end | 34,018 | |||

Increase for fair value of awards granted during year that vested during year | 63,723 | |||

Change in fair value from prior year-end to year-end of awards granted in a prior year that were outstanding and unvested at year-end | 2,693 | |||

Change in fair value from prior year-end to vesting date of awards granted in a prior year that vested during year | 529 | |||

Deduction for fair value of awards granted in a prior year that were forfeited during year | - | |||

Increase based upon incremental fair value of awards modified during year | - | |||

Increase based on dividends or other earnings paid during year prior to vesting | - | |||

Total Adjustments | $ | 37,240 | ||

Relationship between Pay and Performance

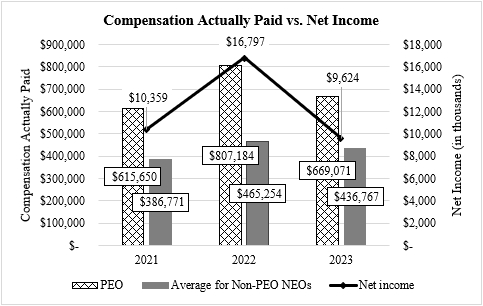

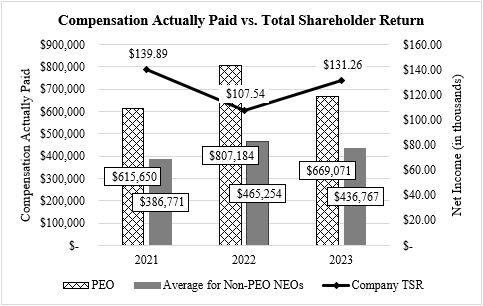

The relationship between compensation actually paid to our PEO and the average of the compensation actually paid to our other non-PEO NEOs and the performance measures shown in the table above is described in further detail below. As illustrated below, the compensation actually paid to our PEO and the other non-PEO NEOs, as calculated in accordance with the remainder vestingSEC requirements, decreased from 2022 to 2023 and the Company’s net income also decreased when comparing the periods. However, when comparing compensation to the TSR, the metrics were not aligned over the two-year period as the TSR increased, while compensation decreased. In addition to our financial performance, we also evaluate all elements of our NEO compensation based on qualitative factors and an evaluation of competitive compensation levels with other comparable institutions.

The following charts provide information to compare the relationship over each of the years in two equal annual installments beginning February 14, 2019.

Relationship Between Compensation Actually Paid and Our Net Income

The graph below shows the relationship between the compensation actually paid to our PEO and the average compensation actually paid to our non-PEO NEOs and our net income.

Relationship Between Compensation Actually Paid and Our TSR

The graph below shows the relationship between the compensation actually paid to our PEO and the average compensation actually paid to our non-PEO NEOs and our TSR.

Director Compensation

The following table provides information about director compensation for the year ended December 31, 2017.

Director Compensation

Name | Fees Earned or Paid in Cash ($) (1) | Stock Awards ($) (2) | Total ($) | ||||

| Emily Marlow Beck | 20,400 | 5,200 | 25,600 | ||||

| Boyce E. Brannock | 20,400 | 5,200 | 25,600 | ||||

| Elizabeth H. Cottrell | 26,850 | 5,200 | 32,050 | ||||

| Miles K. Davis | 20,400 | 5,200 | 25,600 | ||||

| Christopher E. French | 20,400 | 5,200 | 25,600 | ||||

| W. Michael Funk | 20,400 | 5,200 | 25,600 | ||||

| Scott C. Harvard | — | — | — | ||||

| Gerald F. Smith, Jr. | 21,420 | 5,200 | 26,620 | ||||

| James R. Wilkins, III | 20,400 | 5,200 | 25,600 | ||||

Name | Fees Earned or Paid in Cash (1) | Stock Awards (2) | Total | |||||||||

Jason C. Aikens | $ | 27,450 | $ | 22,425 | $ | 49,875 | ||||||

Emily Marlow Beck | $ | 27,450 | $ | 22,425 | $ | 49,875 | ||||||

Boyce Brannock | $ | 27,450 | $ | 22,425 | $ | 49,875 | ||||||

Elizabeth H. Cottrell | $ | 37,616 | $ | 22,425 | $ | 60,041 | ||||||

W. Michael Funk | $ | 27,450 | $ | 22,425 | $ | 49,875 | ||||||

Scott C. Harvard | $ | — | $ | — | $ | — | ||||||

George Edwin Holt, III | $ | 27,450 | $ | 22,425 | $ | 49,875 | ||||||

Kirtesh Patel | $ | 27,450 | $ | 22,425 | $ | 49,875 | ||||||

Gerald F. Smith, Jr. | $ | 28,670 | $ | 22,425 | $ | 51,095 | ||||||

James R. Wilkins, III | $ | 27,450 | $ | 22,425 | $ | 49,875 | ||||||

(1) | Amounts represent retainer fees paid by the Company to directors on a monthly basis for board meetings. |

(2) | The amounts in this column reflect the aggregate grant date fair value of the awards computed in accordance with the Financial Accounting Standards Boards Accounting Standards Codification Topic 718, Compensation – Stock Compensation (formerly FASB 123R, Share-Based Payment). The grant date fair value for these stock awards of |

Non-employee directors receive a retainer fee of $1,700$2,362.50 per month. They do not receive additional fees for attending meetings. The ChairmanChair of the Board receives an additional retainer fee of $650$875 per month, and the Vice Chairman of the Board receives an additional retainer fee of $85$105 per month. Scott C. Harvard, President and Chief Executive Officer of the Company, did not receive fees for his service on the Board.

Whenever the Company deems it appropriate to grant a stock award, the recipient receives a specified number of unrestricted shares of employer stock.Common Stock. During 2017,2023, the Company granted 2,72811,700 unrestricted shares of common stockCommon Stock under the SIP to members of the Board of Directors for their dedicated service and support. There were no unvested stock awards outstanding for directors atas of December 31, 2017.

Certain Relationships and Related Party Transactions

Some of the directors and officers of the Company are customers of the Bank. No loans to directors or officers involve more than the normal risks of collectability or present other unfavorable features, or are non-accrual, past due, restricted, or considered potential problem loans. All such loans were made in the ordinary course of business and were originated on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with persons not related to the Company or the Bank. The balances of loans to directors, executive officers, and their related interests totaled $225 thousand at$1.1 million as of December 31, 2017,2023, or less than 1% of the Company’s equity at that date.

The Company has adopted a formal written policy that covers the review and approval of related party transactions by the Board. The Board reviews all such transactions that are proposed to it for approval. During such a review, the Board will consider, among other things, the related party’s relationship to the Company, the facts and circumstances of the proposed transaction, the aggregate dollar amount of the transaction, the related person’s relationship to the transaction, and any other material information. Based on the Company’s Conflict of Interest Policy, the Board also has the responsibility to review conflicts of interest involving directors or executive officers.

AUDIT-RELATED MATTERS

Audit Committee Report

The Audit Committee is comprised of four directors, each of whom is independent within the meaning of the listing standards of NASDAQ.Nasdaq. The Audit Committee operates under a written charter adopted by the Board of Directors. The Audit Committee reviews its charter at least annually and revises it as necessary to ensure compliance with current regulatory requirements.

Management is responsible for:

● | Establishing and maintaining the Company’s internal controls over financial reporting; |

● | Assessing the effectiveness of the Company's internal controls over financial reporting; | |

● | The preparation, presentation, and integrity of the Company’s consolidated financial statements; and |

● | Compliance with laws, rules and regulations, and ethical business standards. |

The Company’s independent registered public accounting firm is responsible for:

● | Performing an independent audit of the Company’s consolidated financial statements. |

The Audit Committee is responsible for the oversight of the Company’s:

● | Accounting and financial reporting processes; |

● | Internal controls over financial reporting; and |

● | The appointment, compensation, retention, and oversight of the work of the independent registered public accounting firm engaged for the purpose of preparing and issuing an audit report or performing other services for the Company. |

In this context, the Audit Committee has met and had discussions with management and Yount, Hyde & Barbour, P.C., the Company’s independent registered public accounting firm.

Management represented to the Audit Committee that the Company’s consolidated financial statements for the year ended December 31, 20172023 were prepared in accordance with U.S. generally accepted accounting principles. The Audit Committee has reviewed and discussed these consolidated financial statements with management and Yount, Hyde & Barbour, P.C., including the scope of the independent registered public accounting firm’s responsibilities, critical accounting policies and practices used, and significant financial reporting issues and judgments made by management in connection with the preparation of such financial statements.

The Audit Committee discussed and reviewed with the independent auditors all communications required by accounting principles generally accepted in the United States of America, and standards of the Public Company Accounting Oversight Board (PCAOB), including those described in Auditing Standard No. 16,1301, “Communication with Audit Committees,” and Rule 2-07 of Regulation S-X promulgated by the SEC, as modified or supplemented, and, with and without management present, discussed and reviewed the results of the independent auditors’ examinationexaminations of the financial statements. The Audit Committee has received the written disclosures and the letter from Yount, Hyde & Barbour, P.C. required by applicable requirements of the PCAOB regarding Yount, Hyde & Barbour, P.C.’s communications with the Audit Committee and discussed with Yount, Hyde & Barbour, P.C. the firm’s independence from the Company. Moreover, the Audit Committee has considered whether the provision of the audit services described above is compatible with maintaining the independence of the independent registered public accounting firm.

Based upon its discussions with management and Yount, Hyde & Barbour, P.C., and its review of the representations of management and the report of Yount, Hyde & Barbour, P.C. to the Audit Committee, the Audit Committee recommended to the Board that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017 for2023 filing with the SEC. By recommending that the audited consolidated financial statements be so included, the Audit Committee is not providing an opinion on the accuracy, completeness or presentation of the information contained in the audited financial statements.

Members of the Audit Committee:

Emily Marlow Beck

W. Michael Funk

George Edwin Holt, III

Gerald F. Smith, Jr.

Policy for Approval of Audit and Permitted Non-Audit Services

All audit-related services, tax services, and other services, as described above, were pre-approved by the Audit Committee, which concluded that the provision of such services by Yount, Hyde & Barbour, P.C. was compatible with the maintenance of that firm’s independence in the conduct of its auditing functions. The Audit Committee Charter provides for pre-approval of the auditor’s fees and is available on the Company’s website at

www.fbvirginia.com under “Investor Relations/Corporate Governance/Documents.” As provided for in the Charter, the Committee reviews, prior to the annual external audit, the scope and general extent of the auditor’s audit procedures, including their engagement letter. The Committee also reviews the extent of non-audit services provided by the external auditors in relation to the objectivity needed in their audit. It was determined the external auditors maintained objectivity considering the non-audit services provided.Auditor Fees and Services

Audit Fees

The aggregate fees billed by Yount, Hyde & Barbour, P.C. for professional services rendered for the audit of the Company’s annual financial statements for the fiscal years ended December 31, 20172023 and 2016,2022, and for the review of the financial statements included in the Company's Quarterly Reports on Form 10-Q and services that are normally provided in connection with statutory and regulatory filings and engagements for those fiscal years were $75,675$194,000 for 20172023 and $73,650$166,000 for 2016.

Audit-Related Fees